With a rapidly expanding economy, cost-effective labour, and a business-friendly environment, Bangladesh offers compelling opportunities for foreign companies aiming to scale in South Asia.

The country offers many opportunities across various industries. With its strategic location for international trade, abundant resources like fertile soil, water, and natural gas, many foreign companies are choosing Bangladesh to set up their operations.

This blog will guide you through the legal aspects and steps required to form a company in Bangladesh.

A Step-by-Step Procedure for Private Limited Company Registration in Bangladesh

Expanding into Bangladesh? The first step is securing your company’s registration, laying the foundation to operate legally, build credibility, and grow your business with confidence.

However, the registration procedure is elaborate and complex. We have described the process of company registration in Bangladesh along with its benefits and requirements in this blog.

What is a Private Limited Company?

A Private Limited Company is a privately owned business where shareholders enjoy limited liability. It keeps financial information confidential and provides the flexibility to conduct operations, generate profits, and carry out lawful business activities with ease.

Foreign companies can fully own a private limited company in Bangladesh, making it a popular choice for international investors.

Benefits of a Private Limited Company

- Separate Legal Identity – A private limited company has a distinct legal standing.

- Unlimited Continuity – The company continues irrespective of shareholder changes.

- Easy Entry and Exit – Minimal barriers to starting or closing operations.

- Attractive to Foreign Investment – Foreign investors can fully own the company.

- Limited Liability – Shareholders’ liability is limited to their capital investment.

- Low Paid-Up Capital – It possesses a very low paid-up capital threshold.

- Easy Share Transfer – Any member of the company can readily acquire the shares.

Requirements for a Private Limited Company

- Name Clearance: Obtain approval from RJSC for the company name.

- Directors: Minimum of 2 and a maximum of 50 directors (foreign or Bangladeshi). Age limit minimum of 20 years old. Directors must be free of malpractice or bankruptcy, hold AOA-required shares, and may be nominated by corporate shareholders.

- Shareholders: Minimum of 2 and a maximum of 50 shareholders (individual or corporate). A director and shareholder can be the same person or different. 100% foreign shareholdings are allowed.

- Registered Address: The company must have a local address in Bangladesh.

- Share Capital: Minimum capital of BDT 1 per shareholder. Shares can be issued or transferred at any time after the company’s incorporation

- Documentation: The highest amount of share capital a business is permitted to distribute to its owners, as specified in the MOA, AOA, and other required documents.

In addition, yearly compliance requires submitting audited accounts, annual returns, and tax filings.

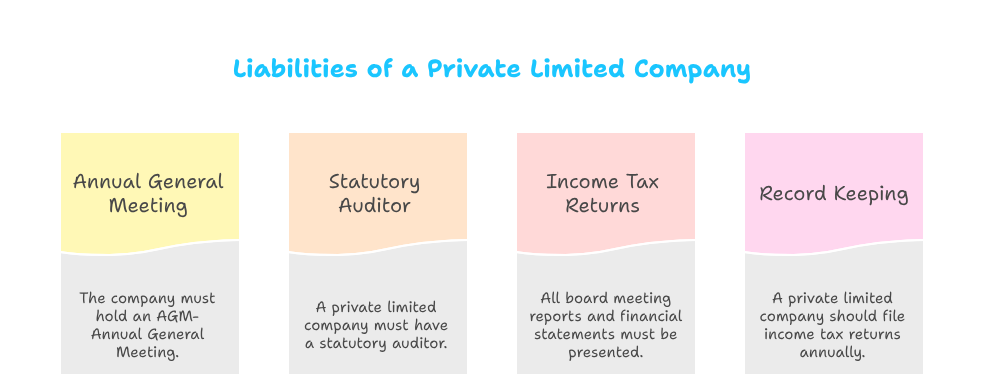

Liabilities of a Private Limited Company

- Annual General Meeting (AGM): Must be held annually; first AGM within 18 months of incorporation, subsequent AGMs within 15 months. (Companies Act, 1994, Sections 96–97)

- Statutory Auditor: Appointment of a qualified auditor is mandatory. (Companies Act, 1994, Section 210)

- Income Tax Returns: Annual filing with NBR, including audited financial statements. (Income Tax Ordinance, 2023)

- Record Keeping: Maintain books of accounts, board meeting minutes, and share registers at the registered office for inspection. (Companies Act, 1994, Sections 183–189)

Documents Required for Private limited Company Registration in Bangladesh

For Non-Operating Bank Account:

- Name Approval Certificate from RJSC

- MOA & AOA: Create the MOA and AOA of the proposed company in Bangladesh

- Board Resolution/Promoters’ Meeting Minutes

- NID/Passport Copies of all shareholders

- Photographs of shareholders and directors

- Completed Bank Account Application Form with signature.

- Name Approval Certificate from RJSC

For Corporate Shareholders:

- Share Tree Analysis for corporate shareholders

- Passports and Photographs of all nominee directors

- Passports and Photographs of all shareholders of the parent company/corporate shareholder

- Incorporation Certificate and MOA-Memorandum/Article of Association (AOA Audit) Report. All those documents must be translated into English and notarised.

- Share Tree Analysis for corporate shareholders

For Company Registration:

- Copy of the MOA and AOA of the proposed company

- Signed Subscriber Page

- Signed Form-VI (declaration of registered address)

- Signed Form-IX (consent of the directors)

Step-by-Step Process for Private Limited Company Registration

Step 1: Name Approval

Start by applying for name clearance from the RJSC. The company must pay the fees associated with name clearing and verification.

Usually, the certificate arrives in one or two days. The validity of name clearance approval is viable for 30 days.

Step 2: Draft Required Documents

Prepare and sign the necessary documents:

- Memorandum of Association (MOA)

- Article of Association (AOA)

- Form-VI (Notice of Registered Address)

- Form-IX (Directors’ Consent)

- Board Resolution/ Promoters’ Meeting Minutes

- Memorandum of Association (MOA)

Note: The above-mentioned documents must be crafted.

Step 3: Open a Non-Operating Bank Account

Before applying to RJSC for company registration, a non-operating bank account with any scheduled commercial in Bangladesh must be formed in order to get inward remittance, according to the Bangladesh Foreign Exchange Regulations.

The bank will give you an Encashment Certificate for the purpose of payment after they have received the remittance. Before the confirmation of the company registration is ensured, RJSC will check with the issuing bank for the Encashment Certificate.

Step 4: Inward Equity Remittance

Following the Bangladesh Foreign Exchange Regulations, the procedure of inward equity remittance must be completed before the submission of the company registration application to the RJSC. The procedure is as follows-

- The paid-up capital must be put down by the shareholders to the non-operating bank account.

- Remittances must be sent through SWIFT.

- It may require around 48-72 hours to receive the payment in Bangladesh.

- An Encashment Certificate will be given by the bank upon receipt of the equity remittance.

- The reason for the remittance must be listed as “Equity Investment” on SWIFT.

Step 5: Online Filing to the RJSC Web-portal

Upload the required documents, including:

- Memorandum of Association (MOA) and Articles of Association (AOA)

- Signed Form-VI and Form-IX

- Signed Subscriber Page

- Encashment Certificate

Note: The above-mentioned capital must be uploaded to the RJSC Web Portal. Then, the registration process will be complete.

Documents You Will Receive After Registration

The documents mentioned here will be sent by RJSC as evidence of approval of company registration after the register of RJSC has approved the online application:

- Incorporation Certificate

- Certified Copy of Memorandum of Association (MOA) and Article of Association (AOA)

- Certified Copy of Form- XII (Particulars of Directors)

Other Important Licenses and Registrations

After the company registration has been completed, there are some other significant registrations and business licences required. They are as follows:

- Trade License

- E-TIN (Tax Registration)

- VAT Registration (BIN)

- Chamber of Commerce Membership (for import/export businesses)

- Import Registration Certificate (for import businesses)

- Export Registration Certificate (for export businesses)

Based on the field of your work, you could additionally require other licences and registrations from the relevant government authorities

After going through all the steps, your private limited company will be ready to begin its operations.

AccouSource is more than happy to assist if you need help to get through this intricate process. We assist foreign companies in establishing their business in Bangladesh, as well as offering standard accounting and compliance services.

Conclusion

Bangladesh’s economic growth and foreign investment-friendly policies make it an attractive option for international businesses. A Private Limited Company provides flexibility, legal protection, and easy access to foreign capital. By following the outlined steps, you can efficiently register your company and set it up for success.

AccouSource is here to help you navigate the company registration process and ensure full compliance with local regulations. Get in touch with us for professional guidance every step of the way.