Ready to turn your business idea into reality in Bangladesh?

Setting up legally can be tricky, but with the right guidance, you can navigate the registration process smoothly.

This step-by-step guide shows you how to choose the best structure, complete all necessary filings, and start your venture with confidence.

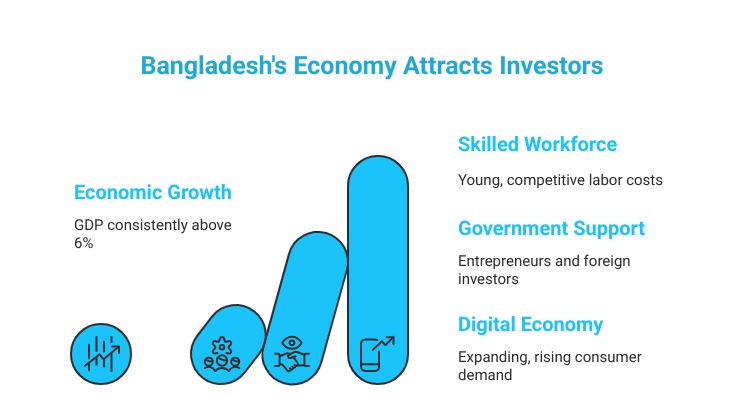

Why Register a Company in Bangladesh?

Bangladesh is one of the fastest-growing economies in Asia, offering an attractive environment for startups, SMEs, and foreign investors. Some key advantages include:

-

- Strong economic growth with GDP consistently above 6%

- Young, skilled workforce at competitive labor costs

- Government support for entrepreneurs and foreign investors

- Expanding digital economy and rising consumer demand

For founders, Bangladesh offers a fertile ground to start and scale businesses across diverse industries.

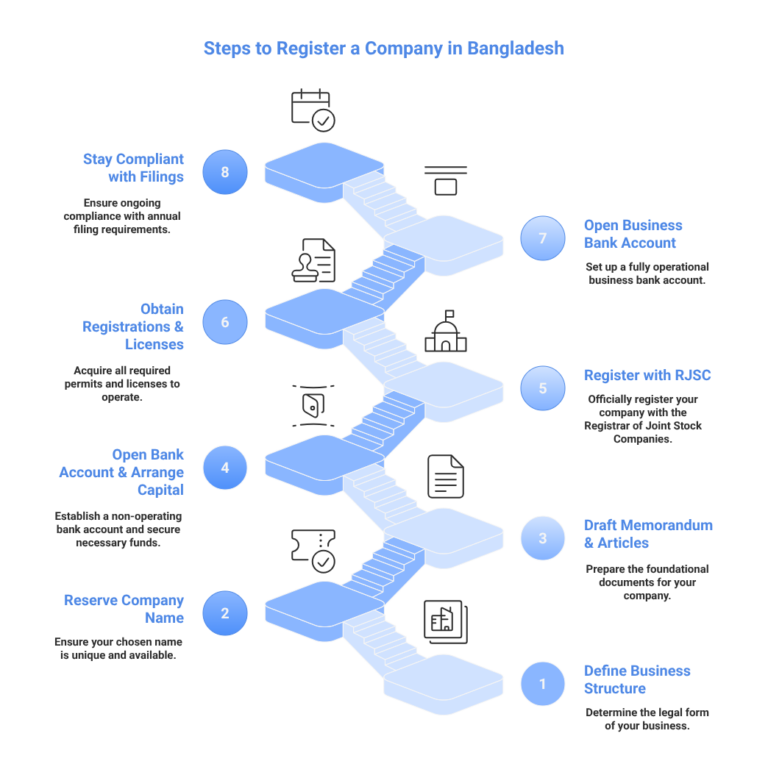

Step 1: Define Your Business Structure

Your incorporation journey starts with choosing the right company type

- Private Limited Company (PLC): The most popular choice for startups and SMEs, requiring 2–50 shareholders.

- Public Limited Company: Designed for larger businesses planning to raise funds publicly.

- Branch Office: Suitable for foreign companies wishing to carry out specific commercial activities in Bangladesh without full incorporation.

- Liaison Office (Representative Office): Ideal for foreign companies engaging only in non-commercial activities like market research, promotion, or coordination.

- Subsidiary Company: A locally registered company that is fully or partially owned by a foreign entity.

👉 For most founders, a Private Limited Company offers flexibility, credibility, and limited liability.

Step 2: Reserve Your Company Name

The next step is reserving a unique company name with the Registrar of Joint Stock Companies and Firms (RJSC).

-

-

- Ensure the name is not already in use.

- It should comply with RJSC naming guidelines.

- Once approved, the name is reserved for a limited period, during which incorporation must be completed.

-

Step 3: Draft the Memorandum & Articles of Association

Two key documents are required for incorporation:

-

- Memorandum of Association (MoA): Defines the scope and objectives of the company.

- Articles of Association (AoA): Outlines internal governance, shareholder rights, and management rules.

You’ll also need to prepare:

-

- Shareholding structure details

- Consent of directors

- Registered business address in Bangladesh

Step 4: Open a Non-Operating Bank Account & Arrange Capital

For companies with foreign shareholders, opening a non-operating bank account is mandatory before incorporation.

- The account is opened in the proposed company’s name.

- Initial paid-up capital is deposited here.

- Foreign investors must remit funds through proper banking channels.

- The bank issues an Encashment Certificate, which must be submitted to RJSC during incorporation.

This ensures compliance with Bangladesh Bank rules and validates foreign investment as legitimate FDI.

Step 5: Register with RJSC

With documents prepared and capital deposited, you can now apply for incorporation with the Registrar of Joint Stock Companies and Firms (RJSC).

This step involves:

-

- Submitting the MoA, AoA, and other forms

- Paying applicable government fees and stamp duty

- Receiving the Certificate of Incorporation, which legally establishes your company

At this point, your idea has officially transformed into a recognized business entity.

Step 6: Obtain Mandatory Registrations & Licenses

After incorporation, your company must secure the necessary registrations and permits. These fall into two categories:

A. Mandatory for All Companies

-

-

- Trade License: Issued by the local City Corporation or Municipality. Without it, no business can legally operate.

- Tax Identification Number (TIN): Required for paying taxes and filing returns.

- VAT Registration (Business Identification Number – BIN): Needed if your business exceeds the VAT threshold or engages in taxable activities.

-

B. Conditional & Sector-Specific Licenses

Depending on your business activity, you may also require:

-

-

- Import/Export Registration Certificate (IRC/ERC) for trading companies

- Industry-specific permits, such as those for banking, telecom, healthcare, or energy businesses

-

Skipping these steps may restrict your company from entering contracts or conducting transactions.

Step 7: Open a Business Bank Account

Once you have completed the mandatory registrations, you can open an operational business bank account.

-

- This account enables day-to-day transactions, including receiving customer payments and paying suppliers.

- It also serves as the approved channel for additional investments and profit repatriation for foreign-owned companies.

- Documents required include your Certificate of Incorporation, MoA & AoA, Board Resolution, Trade License, TIN, and VAT certificate.

Unlike the earlier non-operating account, this is your company’s active financial hub.

Step 8: Stay Compliant with Annual Filings

Company registration is only the beginning. To remain compliant, you must:

-

- File annual returns and updates with RJSC

- Submit tax filings and payments to the National Board of Revenue (NBR)

- Conduct and file annual audits (mandatory for Private Limited Companies)

Renew licenses such as Trade License, Import Registration Certificate (IRC) and Export Registration Certificate (ERC)

-

- Consistent compliance not only avoids penalties but also enhances your company’s credibility with clients, partners, and investors.

The following diagram illustrates all the steps discussed above in a visual format.

Common Challenges for Founders

Many first-time founders face hurdles such as:

-

- Navigating bureaucratic delays

- Understanding tax obligations

- Drafting accurate MoA and AoA

- Meeting banking and FDI requirements

- Complying with industry-specific rules

Working with an experienced company registration and compliance advisor in Bangladesh can save valuable time and prevent costly mistakes.

Final Thoughts

Taking your idea from concept to incorporation in Bangladesh is an exciting journey. By following the steps—choosing a structure, reserving your name, preparing documents, arranging capital, registering with RJSC, securing licenses, opening a bank account, and staying compliant—you create a strong foundation for business success.

Bangladesh’s thriving economy, supportive regulatory environment, and growing consumer base make it an excellent place to launch and scale your venture. With the right planning and guidance, your startup can move from idea to incorporation seamlessly.