Bangladesh has become one of Asia’s most dynamic economies, attracting investors across sectors such as manufacturing, IT, energy, infrastructure, and services.

But before you dive into this vibrant market, one critical decision will shape your success: What business structure should you choose?

Should you establish a Private Limited Company, operate through a Branch Office, or set up a Liaison Office? The right choice depends on your business goals, level of investment, and operational needs.

Each structure comes with its own set of legal, operational, tax, and compliance implications. The right choice depends on your business objectives, level of investment, and long-term strategy.

In this guide, we will break down the differences, advantages, disadvantages, and use cases of Private Limited Companies, Branch Offices and Liaison Offices in Bangladesh so you can make an informed decision.

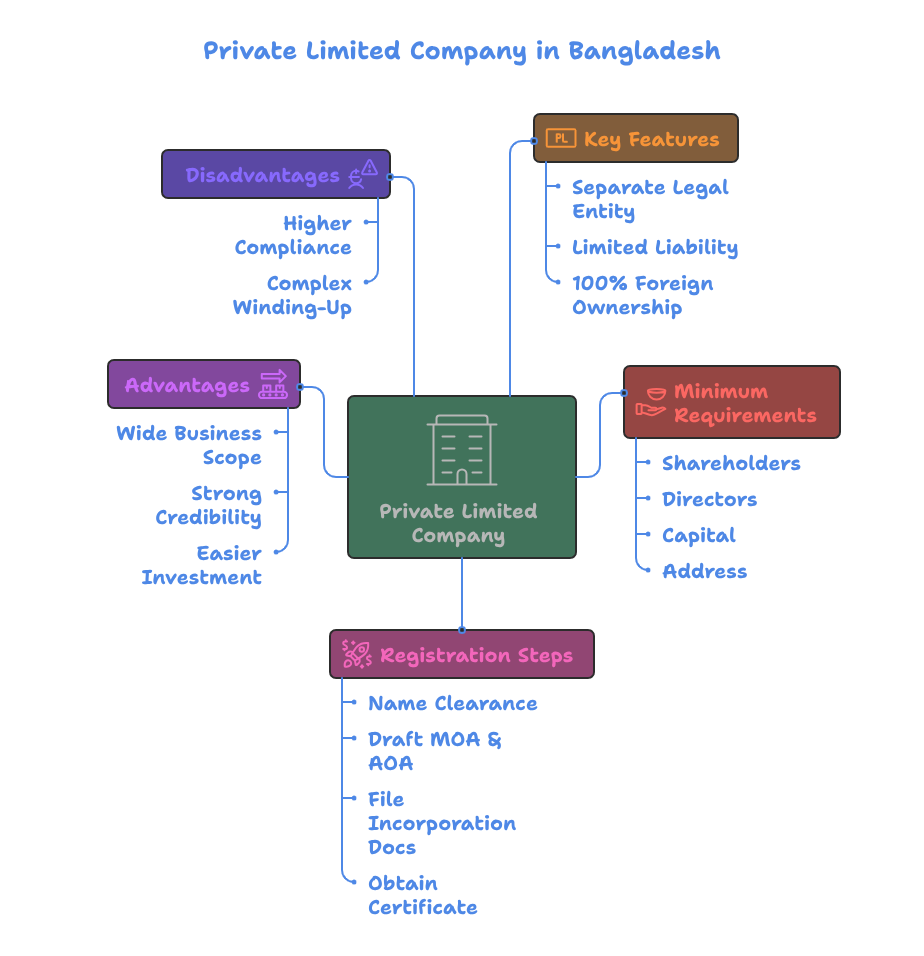

Understanding the Private Limited Company (PLC) Setup

A Private Limited Company is the most common business structure in Bangladesh, especially for foreign investors planning a long-term presence.

Key Features

- Separate legal entity from its shareholders

- Liability limited to shareholding

- Can be fully foreign-owned (except in restricted sectors)

- Eligible to carry out any lawful business activities permitted under its Memorandum of Association

- Separate legal entity from its shareholders

Minimum Requirements for a Private Limited Company in Bangladesh

- Shareholders: Minimum 2 (can be foreign individuals or companies)

- Directors: Minimum 2 (no residency requirement, but having one local director is practical)

- Authorised Capital: No official minimum, though BDT 10 million (~USD 100,000) is commonly used

- Paid-up Capital: No official minimum, but typically ranges from BDT 100,000 – BDT 1,000,000 (~USD 1,000 – USD 10,000)

- Registered Address: Must maintain a local office address in Bangladesh

- Shareholders: Minimum 2 (can be foreign individuals or companies)

Process of Registration

- Name clearance from RJSC (Registrar of Joint Stock Companies & Firms)

- Drafting of Memorandum & Articles of Association

- Filing incorporation documents with RJSC

- Obtaining Certificate of Incorporation

- Post-registration steps: TIN, VAT registration, Trade License, bank account opening

- Name clearance from RJSC (Registrar of Joint Stock Companies & Firms)

Advantages

- Independent legal identity

- Flexibility to conduct a wide range of business activities

- Higher credibility with banks, customers, and regulators

- Easier to raise local investment or enter into joint ventures

- Profit repatriation allowed under Bangladesh Bank guidelines

- Independent legal identity

Disadvantages

- Higher compliance obligations (statutory audits, board meetings, annual filings)

- Winding up is more complex than closing a Branch

- Higher compliance obligations (statutory audits, board meetings, annual filings)

Understanding the Branch Office Setup

A Branch Office is essentially an extension of the foreign parent company in Bangladesh. It is not a separate legal entity but is allowed to carry out specific commercial activities approved by the government.

Key Features

- Operates as a legal extension of the parent company

- Must obtain approval from BIDA (Bangladesh Investment Development Authority)

- Restricted to activities permitted in the approval letter

- Can undertake trading (import/export) and manufacturing, subject to fulfilling the required regulatory conditions.

- Operates as a legal extension of the parent company

Process of Registration

- Application to BIDA with parent company documents, including (but not limited to) audited financial statements and a board resolution.

- Approval granted (usually for 3 years, renewable)

- Registration of filing with the RJSC as a foreign company in Bangladesh

- Filing with the RJSC to be recorded as a Foreign Company for compliance purposes; this does not constitute incorporation

- TIN, VAT, and Trade License registrations

- Application to BIDA with parent company documents, including (but not limited to) audited financial statements and a board resolution.

Advantages

- Direct operational and financial control by the parent company

- Good for project-based or representative activities

- No capital requirement (parent company funds local operations via remittances)

- Direct operational and financial control by the parent company

Disadvantages

- No separate legal identity, parent company bears all liabilities

- Restricted activities, cannot engage in full commercial operations

- A minimum of USD 50,000 is required to be remitted to Bangladesh to cover initial setup costs and six months of operating expenses

- Requires periodic approval renewal from BIDA

- Higher tax scrutiny and regulatory oversight

- Limited perception of independence in the local market

- No separate legal identity, parent company bears all liabilities

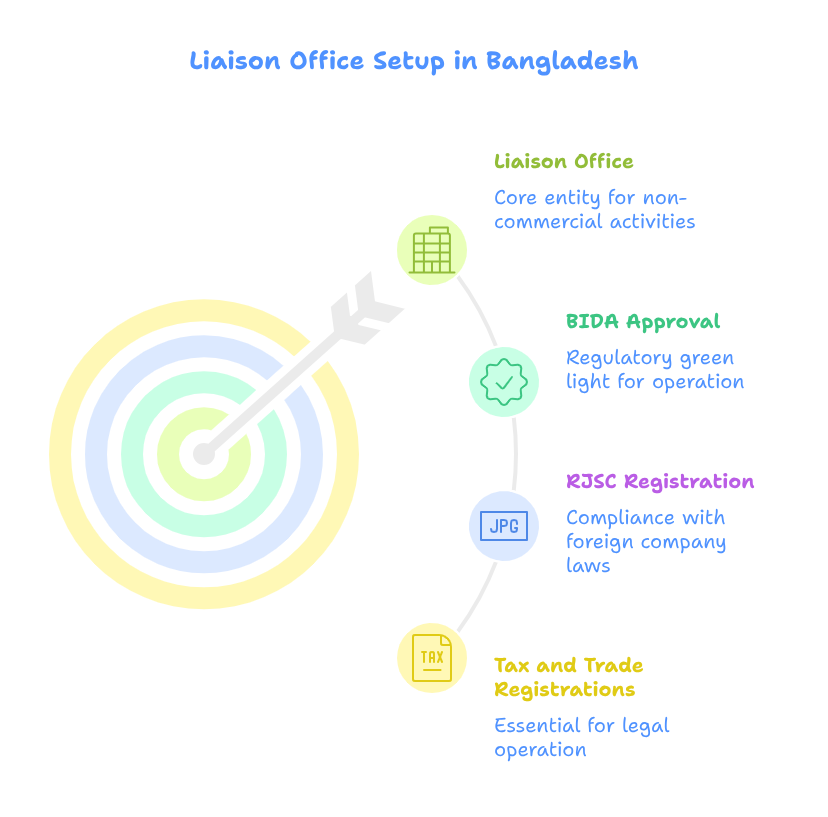

Understanding the Liaison Office Setup

A Liaison Office (also known as a Representative Office) is primarily for non-commercial purposes. It cannot earn income in Bangladesh, but can carry out activities like:

- Market research

- Promoting parent company products or services

- Coordinating projects and communications with local clients

- Market research

Key Features

- Cannot conduct commercial operations or generate revenue

- Must obtain BIDA approval

- Maintains a reporting relationship with the parent company

- Lower compliance burden compared to PLC or Branch Office

- Cannot conduct commercial operations or generate revenue

Process of Setup

- Application to BIDA with parent company documents, including (but not limited to) audited financial statements and a board resolution.

- Approval granted (usually for 3 years, renewable)

- Registration of filing with the RJSC as a foreign company in Bangladesh

- Filing with the RJSC to be recorded as a Foreign Company for compliance purposes; this does not constitute incorporation

- TIN, VAT, and Trade License registrations

- Application to BIDA with parent company documents, including (but not limited to) audited financial statements and a board resolution.

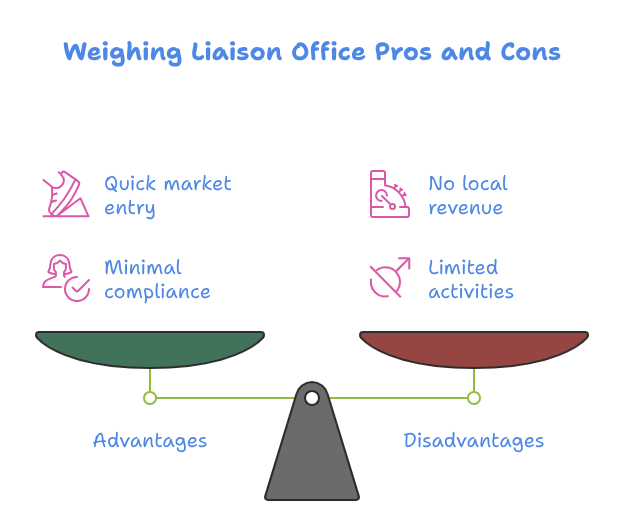

Advantages

- Quick and low-cost market entry

- Minimal regulatory compliance

- Acts as a strategic liaison for the parent company

- Quick and low-cost market entry

Disadvantages

- Cannot generate revenue locally

- Limited activities; strictly regulatory controlled

- No legal entity status

- Cannot generate revenue locally

Comparative Analysis: PLC vs Branch Office vs Liaison Office

| Aspect | Private Limited Company | Branch Office | Liaison Office |

| Legal Identity | Separate legal entity | Extension of the parent | Extension of the parent |

| Ownership | Can be 100% foreign-owned | Fully foreign-owned | Fully foreign-owned |

| Compliance Authority | RJSC + NBR + DIFE + Bangladesh Bank | BIDA + RJSC + NBR + DIFE + Bangladesh Bank | BIDA + RJSC + NBR + DIFE + Bangladesh Bank |

| Operational Scope | Broad; any lawful activity | Restricted to BIDA-approved activities | Non-commercial, promotional only |

| Taxation | Corporate tax applies | Same as PLC; profit repatriation stricter | Cannot earn revenue; no corporate tax |

| Liability | Limited to shareholders | Unlimited; parent liable | Unlimited; parent liable |

| Ease of Setup | Moderate; incorporation required | Lengthy; BIDA approval needed | Lengthy; BIDA approval needed |

| Reputation | Independent, credible | Project-based/limited | Limited market presence |

| Winding Up | Complex; RJSC & court procedures | Easier; close after BIDA approval | Easier; close after BIDA approval |

Which One Should You Choose?

Private Limited Company

- Long-term market presence

- Flexibility to hire and conduct a full-scale business

- Ability to raise local investment or partnerships

- High credibility with clients and regulators

- Long-term market presence

Branch Office

- Project-specific operations

- Testing the market with direct parent control

- Limited, specialised activities like import/export or manufacturing

- Project-specific operations

Liaison Office

- Market research or promotion

- Short-term representation

- Non-commercial operations

- Market research or promotion

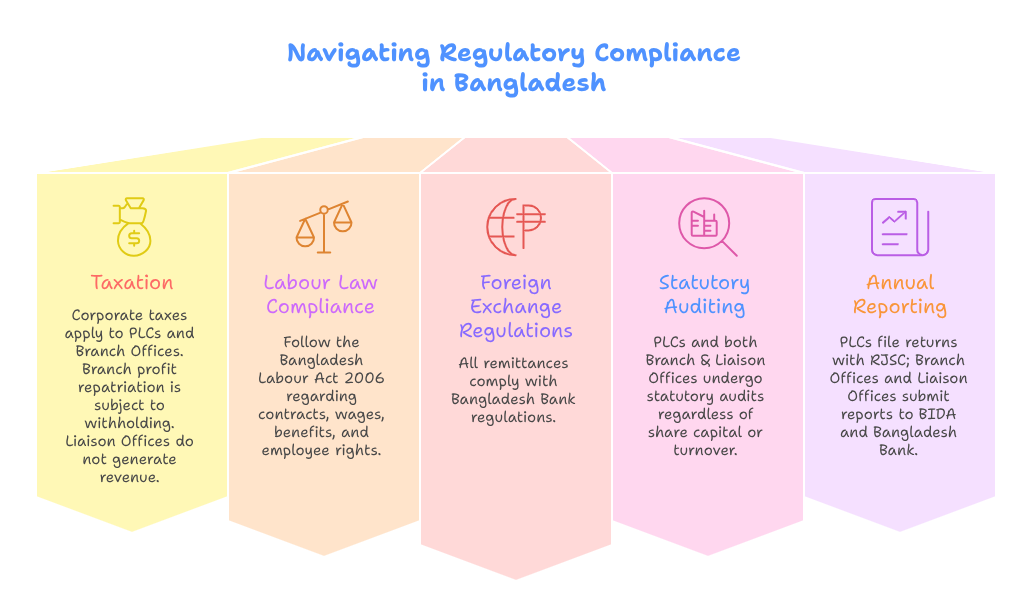

Compliance & Regulatory Considerations

The following rules apply to all foreign companies operating in Bangladesh, regardless of their structure:

- Taxation: Corporate taxes apply to PLCs and Branch Offices; Branch profit repatriation is subject to withholding. Liaison Offices do not generate revenue.

- Labour Law Compliance: Follow the Bangladesh Labour Act 2006 regarding contracts, wages, benefits, and employee rights.

- Foreign Exchange Regulations: All remittances comply with Bangladesh Bank regulations.

- Statutory Auditing: PLCs and both Branch & Liaison Offices undergo statutory audits regardless of share capital or turnover.

- Annual Reporting: PLCs file returns with RJSC; Branch Offices and Liaison Offices submit reports to BIDA and Bangladesh Bank.

- Taxation: Corporate taxes apply to PLCs and Branch Offices; Branch profit repatriation is subject to withholding. Liaison Offices do not generate revenue.

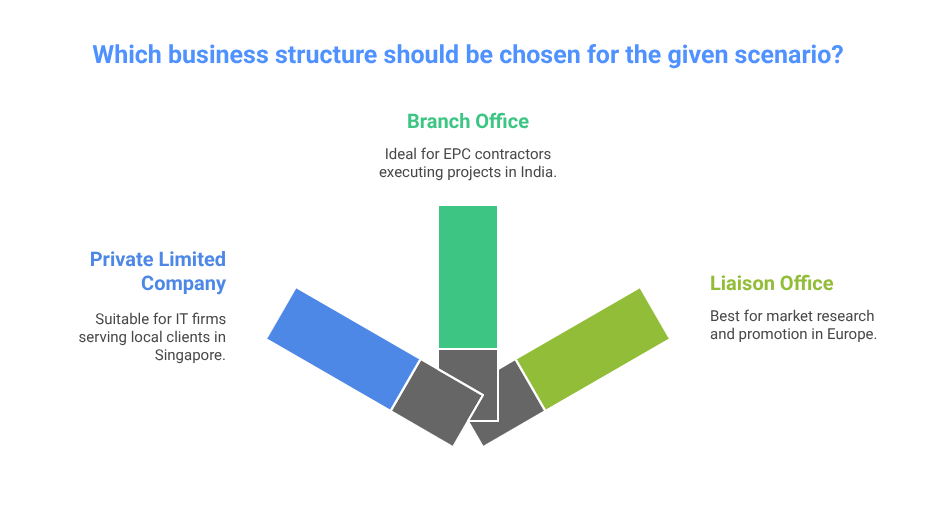

Practical Case Scenarios

IT/Software Company

- Business Type: Private Limited Company

- Scenario: Singapore-based IT firm serving local clients in Bangladesh.

EPC Contractor

- Business Type: Branch Office

- Scenario: Indian engineering firm executing a 2-year project in Bangladesh.

Market Research & Promotion

- Business Type: Liaison Office

- Scenario: European FMCG company conducting consumer trend studies in Bangladesh.

Before Closing

Choosing the right setup depends on your objectives, investment horizon, and operational needs:

- Private Limited Company: Best for long-term operations, full business activities, and local hiring

- Branch Office: Best for specific projects, limited operations, or market testing

- Liaison Office: Best for non-commercial, promotional, or research purposes

Incorporation, approvals, and compliance can be complex. Partnering with AccouSource, you can streamline processes, minimise risks, and facilitate a successful business expansion in Bangladesh.